eFaktura - How does it work?

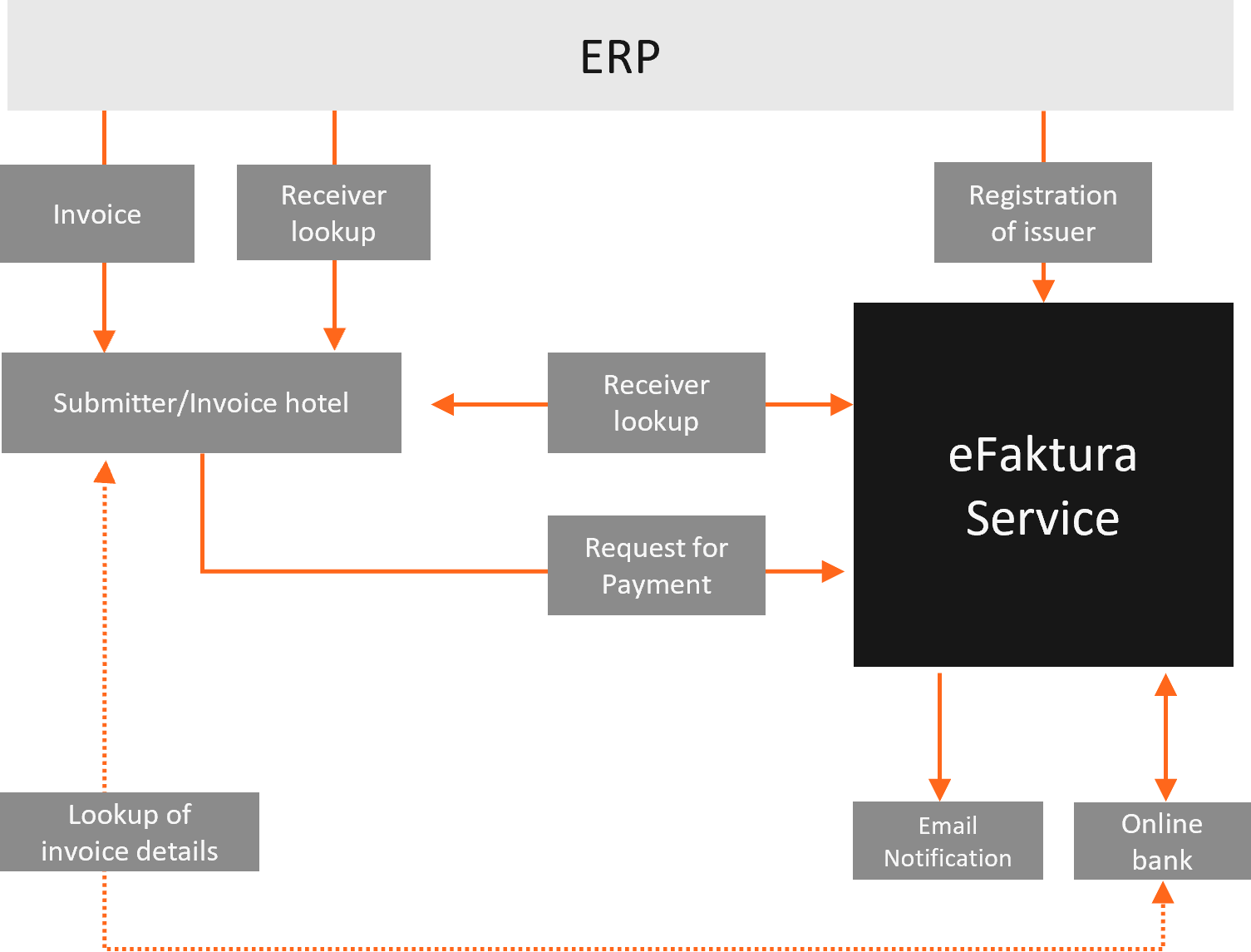

ERP

Systemic overview of the eFaktura Service when invoices are distributed through an ERP through Mastercard Payment Services as the submitter.

ERP that distributes eFaktura using Mastercard Payment Services submitter service.

Invoice containing necessary information to generate request for payment and invoice specification. This information is processed through a submitter which distributes the request for payment through an eFaktura.

Note: Issuers running the eFaktura service in combination with AvtaleGiro should send the AvtaleGiro-file as usual. The same assignments must also be sent as due payment through the eFaktura system and must be labeled with an AvtaleGiro code. These assignments may also contain the due payments to be paid by standard eFaktura.

A service provider that offers issuers electronic receipts, storage and presentation of invoice details. This presentation must be available for 16 months.

Submitter extract the request for payment, including the "eFakturaadresse" from the invoice file and use the eFakturaadresse as a link between consumer and creditor.

In order to secure the invoice information from manipulation and to adhere to the set time limitations, the URL distributed to submitter though Mastercard Payment Services is signed. The submitter must use a encryption technology to decrypt and validate the URL before displaying the invoice information to the receiver.

Submitter may provide value added services in addition to core submitter functionality as described above.

ERP uses a web service to register new issuers directly into production. Agreement with preferred bank must be in place.

Request for payment must be generated in the submitters system based on the information provided by the issuers invoice and sent to for view in the consumer’s online bank. Here the invoice is added with an URL to the invoice specifications.

A request for payment must contain the following information:

- Organization number

- Issuer's name

- Credit card number

- KID (optional, but recommended)

- Amount

- Due date

- eInvoice address (eFakturaIdentifier)

- Reference to invoice details (URL)

- Payment type

The eFaktura service is a solution for distribution and presentation of bills in online banks. This means that the consumer may receive the bills directly into their online bank. The invoice issuer may send and present their invoices electronically to their customers.

eFaktura is not a payment service, but a service that is connected to the payment services that are available to the consumer in the online bank. This may be a standard online bank payment or a payment using direct debit (AvtaleGiro). This secures the business’ reconciliation information.

The same electronic channel may be used for profiling the invoice issuer and the services they offer, along with communications between issuer and their customers.

The solution is available for all businesses and organizations that enter into an agreement with their bank to use this service. The service is also available to all receivers, regardless of which bank they are using. The eFaktura service is available to consumers that use more than one online bank, that is; consumer will find the same eFaktura in any online bank they may use. When paid in one bank the eFaktura disappears from other banks.

The consumer is notified when a new eFaktura is available for payment. Depending on the online bank, different notification methods are available (SMS, email, push notification).

Online bank is the chosen platform to perform request for payments with due date. eFaktura is one of several services available through an online bank.

Through the online bank the consumer is able to view the invoice specifications. This is generated through an automatic request to the submitter which retrieves and displays the information to the consumer.

To distribute eFaktura to consumers, the ERP needs to know who is able to receive and has signed up for eFaktura 2.0 in the Online bank. To find out who is able to receive, the ERP can use a webservice to look up consumers using the alias-solution. If match the eFaktura service will return an eFakturaadresse that will be put on the request for payment to reach the correct consumer with an eFaktura.

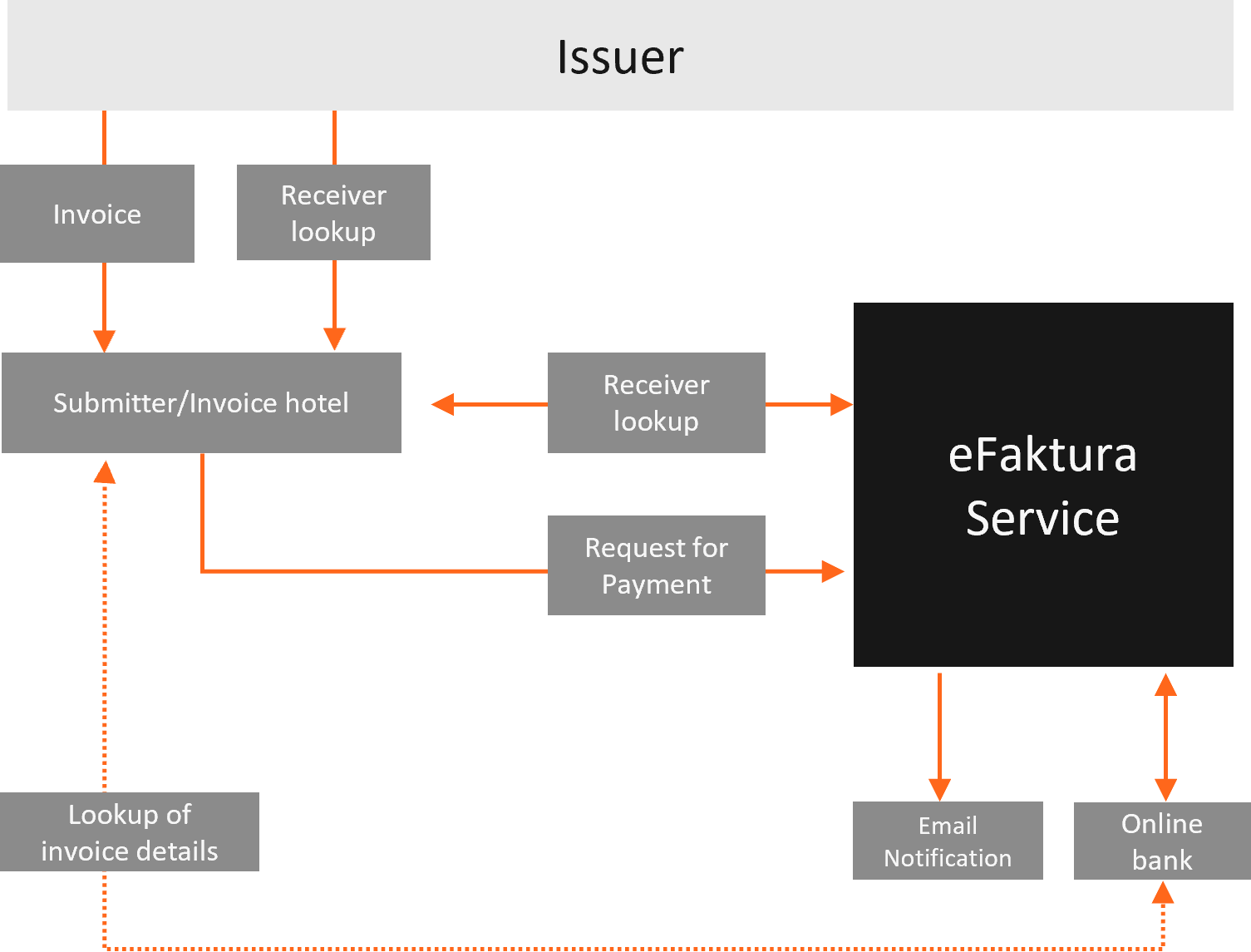

Issuer

Systemic overview of the eFaktura Service when invoices are distributed by an issuer through a third party submitter.

Issuer that distributes eFaktura using a submitter. Submitter handles all integrations between issuer and Mastercard Payment Services. Specifications and questions concerning integration must be directed through the chosen submitter. Mastercard Payment Services is also acting as a submitter.

Invoice containing necessary information to generate request for payment and invoice specification. This information is processed through a submitter which distributes the request for payment through an eFaktura.

Note: Issuers running the eFaktura service in combination with AvtaleGiro should send the AvtaleGiro-file as usual. The same assignments must also be sent as due payment through the eFaktura system and must be labeled with an AvtaleGiro code. These assignments may also contain the due payments to be paid by standard eFaktura.

A service provider that offers issuers electronic receipts, storage and presentation of invoice details.

Submitter extract the "request for payment", including the "eFakturaadresse" from the invoice file and use the eFakturaadresse as a link between consumer and the online bank API (Online 4.0).

In order to secure the invoice information from manipulation and to adhere to the set time limitations, the URL distributed to submitter though Mastercard Payment Services is signed. The submitter must use a encryption technology to decrypt and validate the URL before displaying the invoice information to the receiver.

Submitter may provide value added services in addition to core submitter functionality as described above.

Request for payment must be generated in the submitters system based on the information provided by the issuers invoice and sent to for view in the consumer's online bank. Here the invoice is added with an URL to the invoice specifications.

A request for payment must contain the following information:

- Organization number

- Issuer's name

- Credit card number

- KID (optional, but recommended)

- Amount

- Due date

- eInvoice address (eFakturaIdentifier)

- Reference to invoice details (URL)

- Payment type

The eFaktura service is a solution for distribution and presentation of bills in online banks. This means that the consumer may receive the bills directly into their online bank. The invoice issuer may send and present their invoices electronically to their customers.

eFaktura is not a payment service, but a service that is connected to the payment services that are available to the consumer in the online bank. This may be a standard online bank payment or a payment using direct debit (AvtaleGiro). This secures the business' reconciliation information.

The same electronic channel may be used for profiling the invoice issuer and the services they offer, along with communications between issuer and their customers.

The solution is available for all businesses and organizations that enter into an agreement with their bank to use this service. The service is also available to all receivers, regardless of which bank they are using. The eFaktura service is available to consumers that use more than one online bank, that is; consumer will find the same eFaktura in any online bank they may use. When paid in one bank the eFaktura disappears from other banks.

The consumer is notified when a new eFaktura is available for payment. Depending on the online bank, different notification methods are available (SMS, email, push notification).

Online bank is the chosen platform to perform request for payments with due date. eFaktura is one of several services available through an online bank.

Through the online bank the consumer is able to view the invoice specifications. This is generated through an automatic request to the submitter which retrieves and displays the information to the consumer.

To distribute eFaktura to consumers the issuer needs to know who is able to receive and has signed up for eFaktura 2.0 in the Online bank. To find out who is able to receive the issuer can use a webservice to look up consumers using the alias-solution. If there is a match, the eFaktura service will return a eFakturaadresse that will be put on the request for payment to reach the correct consumer with an eFaktura.